About Fourth Partner Energy

Fourth Partner Energy is a company based in Hyderabad (India) founded in 2010 by Saif Dhorajiwala and Vivek Subramanian.. Fourth Partner Energy has raised $564.02 million across 12 funding rounds from investors including Bank of America, International Finance Corporation and Asian Development Bank. The company has 456 employees as of August 27, 2025. Fourth Partner Energy offers products and services including On-Site Solar Energy, Open Access Solar, Wind Solar Hybrid Energy, Battery Energy Storage Systems, and Carbon Credits. Fourth Partner Energy operates in a competitive market with competitors including Sterling And Wilson, GREW, Mahindra Susten, InSolare Energy and Kiran Energy, among others.

- Headquarter Hyderabad, India

- Employees 456 as on 27 Aug, 2025

- Founders Saif Dhorajiwala, Vivek Subramanian

- Stage Minicorn

-

Sectors

Energy & Utilities

-

Email

***********

-

Phone

*********

-

Website

*********

-

Social

*********

- Legal Name Fourth Partner Energy Private Ltd

- Jurisdiction Hyderabad, Telangana, India

-

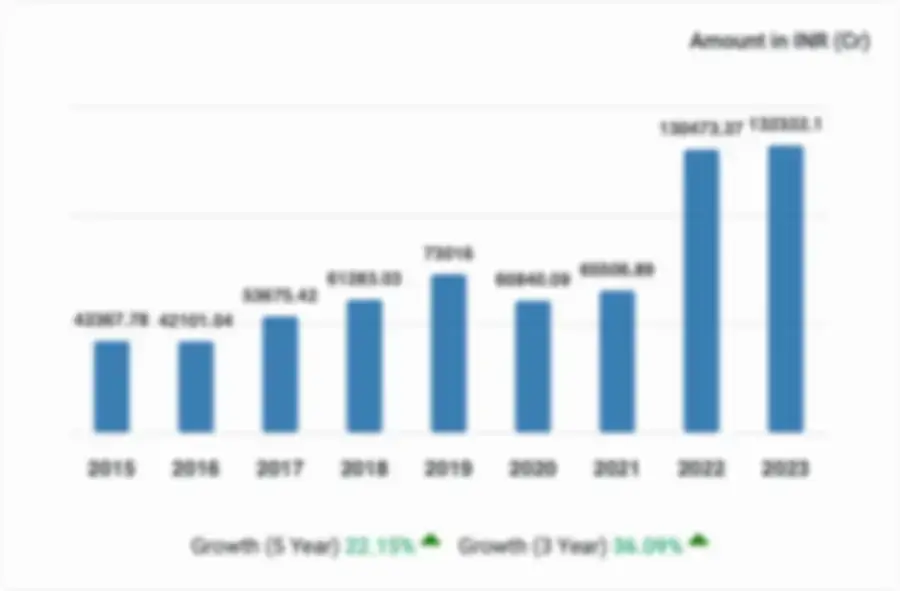

Annual Revenue

$73.08 M (USD)64.79as on Mar 31, 2024

-

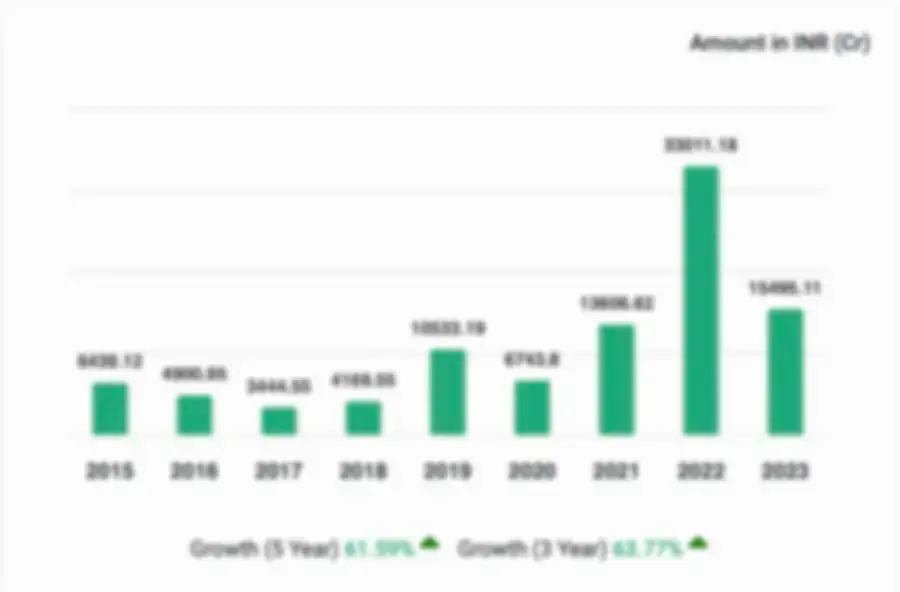

Net Profit

$-40.49 M (USD)-74.17as on Mar 31, 2024

-

EBITDA

$24.52 M (USD)300.16as on Mar 31, 2024

-

Total Equity Funding

$564.02 M (USD)

in 12 rounds

-

Latest Funding Round

$275 M (USD), Series D

Aug 06, 2024

-

Investors

Bank of America

& 27 more

-

Employee Count

456

as on Aug 27, 2025

Unlock complete access to The Company Check

Get unrestricted viewing across everything we track — from companies and brands to investors, funding rounds, acquisitions, financials, and more.

- Unlimited viewing on all profiles Companies, investors, financials, funding, acquisitions & directors

- Full access to every database India & global coverage, advanced filters and rich profile details

- Always-on access from your team account Single premium plan for everything you see on the portal

Products & Services of Fourth Partner Energy

Fourth Partner Energy offers a comprehensive portfolio of products and services, including On-Site Solar Energy, Open Access Solar, Wind Solar Hybrid Energy, Battery Energy Storage Systems, and Carbon Credits. The company's diverse product and service offerings are designed to meet the evolving needs of its customers, address market demands, and provide comprehensive solutions that drive value creation and customer satisfaction across various segments and use cases.

Offers rooftop and ground-mount solar installations for businesses.

Provides off-site clean energy options for industrial clients.

Combines wind and solar for optimized renewable power supply.

Delivers storage solutions for round-the-clock energy needs.

Manages credits for renewable energy projects and emissions reduction.

Unlock access to complete

Unlock access to complete

Funding Insights of Fourth Partner Energy

Fourth Partner Energy has successfully raised a total of $564.02M across 12 strategic funding rounds. The most recent funding activity was a Series D round of $275 million completed in August 2024. This substantial capital infusion reflects strong investor confidence in the company's business model, growth potential, and market opportunities. The funding enables strategic expansion, product development, market penetration, and operational scaling to drive long-term value creation and competitive advantage.

- Total Funding Total Funding

- Total Rounds 12

- Last Round Series D — $275.0M

-

First Round

First Round

(24 Jul 2014)

- Investors Count 28

| Date | Amount | Transaction Name | Valuation | Lead Investors | Investors |

|---|---|---|---|---|---|

| Aug, 2024 | Amount | Series D - Fourth Partner Energy | Valuation |

investors |

|

| Apr, 2024 | Amount | Debt – Conventional - Fourth Partner Energy | Valuation |

investors |

|

| Aug, 2023 | Amount | Series C - Fourth Partner Energy | Valuation | Norfund |

|

| Date | Amount | Transaction Name | Valuation | Lead Investors | Investors |

|---|---|---|---|---|---|

| Jul, 2021 | Amount | Post-IPO - Grab | Valuation |

investors |

|

| Feb, 2021 | Amount | Post-IPO - Grab | Valuation |

investors |

|

| Jan, 2021 | Amount | Post-IPO - Grab | Valuation |

investors |

|

| Feb, 2021 | Amount | Post-IPO - Grab | Valuation |

investors |

Investors in Fourth Partner Energy

Fourth Partner Energy has secured backing from 28 investors, including venture fund, institutional, and angel investors. Prominent investors backing the company include Bank of America, International Finance Corporation and Asian Development Bank. This diverse investor base provides strategic capital, industry expertise, and valuable network connections that support the company's growth initiatives, market expansion, and long-term value creation.

| Investor | Description | Founded Year | Domain | Location |

|---|---|---|---|---|

|

IFC is focused on private sector development in emerging markets.

|

Founded Year | Domain | Location | |

|

Private equity firm focused on growth equities

|

Founded Year | Domain | Location | |

|

It invests in developing countries to create jobs and improve lives

|

Founded Year | Domain | Location |

| Investor | Description | Founded Year | Domain | Location |

|---|---|---|---|---|

|

Single family office of Amitabh Bachchan, founder of Amitabh Bachchan Corporation or AB CORP

|

Founded Year | Domain | Location | |

|

Startup ecosystems are ignited through strategic investments by Signite Partners.

|

Founded Year | Domain | Location | |

|

Venture capital is directed toward companies in multiple sectors.

|

Founded Year | Domain | Location | |

|

Venture capital is invested in cybersecurity, fintech, and AI startups.

|

Founded Year | Domain | Location |

Investments & Acquisitions by Fourth Partner Energy

| Company Name | Description | Domain | Location | Founded Year | Amount |

|---|---|---|---|---|---|

|

Bionic investment advisor platform

|

2016 | ||||

|

Fine Asian gourmet food is offered by an internet-first restaurant.

|

2016 | ||||

|

Physical e-commerce kiosks are deployed for rural purchases in Indonesia.

|

2014 | ||||

|

Fine Asian gourmet food is offered by an internet-first restaurant.

|

2016 |

Financial Statements - Fourth Partner Energy

| Date | Amount | Transaction Name | Valuation | Lead Investors | Investors |

|---|---|---|---|---|---|

| Jul, 2021 | Amount | Post-IPO - Grab | Valuation |

investors |

|

| Feb, 2021 | Amount | Post-IPO - Grab | Valuation |

investors |

|

| Jan, 2021 | Amount | Post-IPO - Grab | Valuation |

investors |

|

| Feb, 2021 | Amount | Post-IPO - Grab | Valuation |

investors |

Fourth Partner Energy Comparisons

Competitors of Fourth Partner Energy

Fourth Partner Energy operates in a dynamic and competitive business environment, facing competition from various established players and emerging companies in the market. The competitive landscape includes prominent companies such as Sterling And Wilson, GREW, Mahindra Susten, InSolare Energy and Kiran Energy, among others. This competitive environment drives innovation, market differentiation, and strategic positioning as companies strive to capture market share and deliver value to their customers. Understanding the competitive dynamics is crucial for assessing market positioning, identifying growth opportunities, and navigating the challenges inherent in a competitive marketplace.

| Company Name | Domain | Founded year | HQ Location | Description |

|---|---|---|---|---|

| domain | founded_year | HQ Location |

EPC and MEP services are provided across diverse sectors.

|

|

| domain | founded_year | HQ Location |

Provider of a range of solar products and services

|

|

| domain | founded_year | HQ Location |

Turnkey EPC services for solar power plants are provided.

|

|

| domain | founded_year | HQ Location |

Solar large-scale projects are developed and installed by InSolare Energy.

|

|

| domain | founded_year | HQ Location |

Grid-connected solar PV plants are developed and operated.

|

| Company Name | Domain | Founded year | HQ Location | Description |

|---|---|---|---|---|

| domain | founded_year | HQ Location |

Multiple services are booked via an app-based platform.

|

|

| domain | founded_year | HQ Location |

On-demand services are booked through an app-based platform.

|

|

| domain | founded_year | HQ Location |

App based platform offering on demand delivery and ride-hailing services

|

|

| domain | founded_year | HQ Location |

Operates an on-demand hyperlocal delivery app for food and groceries.

|

Latest news on Fourth Partner Energy

Frequently Asked Questions about Fourth Partner Energy

When was Fourth Partner Energy founded?

Fourth Partner Energy was founded in 2010 and raised its 1st funding round 4 years after it was founded.

Where is Fourth Partner Energy located?

Fourth Partner Energy is headquartered in Hyderabad, India. It is registered at Hyderabad, Telangana, India.

Is Fourth Partner Energy a funded company?

Fourth Partner Energy is a funded company, having raised a total of $564.02M across 12 funding rounds to date. The company's 1st funding round was a Series C of $42.28M, raised on Jul 24, 2014.

How many employees does Fourth Partner Energy have?

As of Aug 27, 2025, the latest employee count at Fourth Partner Energy is 456.

What is the annual revenue of Fourth Partner Energy?

Annual revenue of Fourth Partner Energy is $73.08M as on Mar 31, 2024.

What does Fourth Partner Energy do?

Fourth Partner Energy was founded in 2010 in Hyderabad, India, within the solar energy sector. End-to-end capabilities are offered, encompassing design, turnkey execution, servicing, and financial structuring for captive solar assets. Services target educational institutions, banks, petrol pumps, and residential complexes. Products such as pumps, lanterns, and street light systems are also supplied. Funds of INR 18 to 20 crore are sought to expand into the B2B segment.

Who are the top competitors of Fourth Partner Energy?

Fourth Partner Energy's top competitors include GREW, Sukhbir Agro Energy and Mahindra Susten.

What products or services does Fourth Partner Energy offer?

Fourth Partner Energy offers On-Site Solar Energy, Open Access Solar, Wind Solar Hybrid Energy, Battery Energy Storage Systems, and Carbon Credits.

Who are Fourth Partner Energy's investors?

Fourth Partner Energy has 28 investors. Key investors include Bank of America, International Finance Corporation, Asian Development Bank, TPG, and Norfund.

What is Fourth Partner Energy's valuation?

The valuation of Fourth Partner Energy is $258.8M as of Aug 2023.