About H1

H1 is a company based in New York (United States) founded in 2017 by Ian Sax and Ariel Katz. It operates as a SaaS (Software-as-a-Service), Data-as-a-Service, and HealthTech. H1 has raised $378.86 million across 7 funding rounds from investors including Novartis, European Union and Shore Group. H1 has completed 3 acquisitions, including Carevoyance, Faculty Opinions and Ribbon Health. H1 offers products and services including Site Universe, Patient Universe, HCP Universe, Prescriber Universe, and H1 Foundation. H1 operates in a competitive market with competitors including System Analytic, PeakData, QPharma, Aissel and Viscira, among others.

- Headquarter New York, United States

- Founders Ian Sax, Ariel Katz

- Stage Minicorn

-

Sectors

Healthcare

-

Email

***********

-

Phone

*********

-

Website

*********

-

Social

*********

-

Annual Revenue

-

Net Profit

-

EBITDA

-

Total Equity Funding

$378.86 M (USD)

in 7 rounds

-

Latest Funding Round

$123 M (USD), Series C

Jun 08, 2022

-

Investors

Novartis

& 12 more

-

Employee Count

Employee Count

-

Investments & Acquisitions

Carevoyance

& 2 more

Unlock complete access to The Company Check

Get unrestricted viewing across everything we track — from companies and brands to investors, funding rounds, acquisitions, financials, and more.

- Unlimited viewing on all profiles Companies, investors, financials, funding, acquisitions & directors

- Full access to every database India & global coverage, advanced filters and rich profile details

- Always-on access from your team account Single premium plan for everything you see on the portal

Products & Services of H1

H1 offers a comprehensive portfolio of products and services, including Site Universe, Patient Universe, HCP Universe, Prescriber Universe, and H1 Foundation. The company's diverse product and service offerings are designed to meet the evolving needs of its customers, address market demands, and provide comprehensive solutions that drive value creation and customer satisfaction across various segments and use cases.

Sites are chosen with comprehensive clinical landscape views.

Patient recruitment and enrollment are accelerated effectively.

Top HCPs and KOLs are discovered with insights.

Top prescribers are identified with detailed HCP profiles.

Accurate provider and network data are comprehensively provided.

Unlock access to complete

Unlock access to complete

Funding Insights of H1

H1 has successfully raised a total of $378.86M across 7 strategic funding rounds. The most recent funding activity was a Series C round of $123 million completed in June 2022. This substantial capital infusion reflects strong investor confidence in the company's business model, growth potential, and market opportunities. The funding enables strategic expansion, product development, market penetration, and operational scaling to drive long-term value creation and competitive advantage.

- Total Funding Total Funding

- Total Rounds 7

- Last Round Series C — $123.0M

-

First Round

First Round

(29 Oct 2018)

- Investors Count 13

| Date | Amount | Transaction Name | Valuation | Lead Investors | Investors |

|---|---|---|---|---|---|

| Jun, 2022 | Amount | Series C - H1 | Valuation |

investors |

|

| Dec, 2021 | Amount | Grant - H1 | Valuation |

investors |

|

| Nov, 2021 | Amount | Series C - H1 | Valuation | Altimeter Capital |

| Date | Amount | Transaction Name | Valuation | Lead Investors | Investors |

|---|---|---|---|---|---|

| Jul, 2021 | Amount | Post-IPO - Grab | Valuation |

investors |

|

| Feb, 2021 | Amount | Post-IPO - Grab | Valuation |

investors |

|

| Jan, 2021 | Amount | Post-IPO - Grab | Valuation |

investors |

|

| Feb, 2021 | Amount | Post-IPO - Grab | Valuation |

investors |

Investors in H1

H1 has secured backing from 13 investors, including institutional and venture fund investors. Prominent investors backing the company include Novartis, European Union and Shore Group. This diverse investor base provides strategic capital, industry expertise, and valuable network connections that support the company's growth initiatives, market expansion, and long-term value creation.

| Investor | Description | Founded Year | Domain | Location |

|---|---|---|---|---|

|

Healthcare startups are funded by this venture capital firm.

|

Founded Year | Domain | Location | |

|

Early-stage venture capital firm investing in AI, healthcare, and tech sectors.

|

Founded Year | Domain | Location | |

|

Long/short equity hedge fund and VC fim

|

Founded Year | Domain | Location |

| Investor | Description | Founded Year | Domain | Location |

|---|---|---|---|---|

|

Single family office of Amitabh Bachchan, founder of Amitabh Bachchan Corporation or AB CORP

|

Founded Year | Domain | Location | |

|

Startup ecosystems are ignited through strategic investments by Signite Partners.

|

Founded Year | Domain | Location | |

|

Venture capital is directed toward companies in multiple sectors.

|

Founded Year | Domain | Location | |

|

Venture capital is invested in cybersecurity, fintech, and AI startups.

|

Founded Year | Domain | Location |

Investments & Acquisitions by H1

H1 has strategically engaged in corporate development activities, having acquired 3 companies. Notable acquisitions include Carevoyance, Faculty Opinions and Ribbon Health. These strategic investments and acquisitions demonstrate the company's commitment to growth through portfolio expansion, market consolidation, technology integration, and strategic partnerships that enhance competitive positioning and drive long-term value creation.

| Company Name | Description | Domain | Location | Founded Year | Amount |

|---|---|---|---|---|---|

|

Bionic investment advisor platform

|

2016 | ||||

|

Fine Asian gourmet food is offered by an internet-first restaurant.

|

2016 | ||||

|

Physical e-commerce kiosks are deployed for rural purchases in Indonesia.

|

2014 | ||||

|

Fine Asian gourmet food is offered by an internet-first restaurant.

|

2016 |

| Company Name | Description | Domain | Location | Founded Year | Amount |

|---|---|---|---|---|---|

|

Online search portal for discovering life sciences scientific literature

|

2019 | ||||

|

Predictive analytics platform is provided for healthcare providers.

|

2016 | ||||

|

Marketing platform that helps medical technology companies

|

2014 |

| Company Name | Description | Domain | Location | Founded Year | Amount |

|---|---|---|---|---|---|

|

OVO is recognized as a smart digital payment application.

|

2017 | ||||

|

Bionic investment advisor platform

|

2016 | ||||

|

Physical e-commerce kiosks are deployed for rural purchases in Indonesia.

|

2014 | ||||

|

Physical e-commerce kiosks are deployed for rural purchases in Indonesia.

|

2014 |

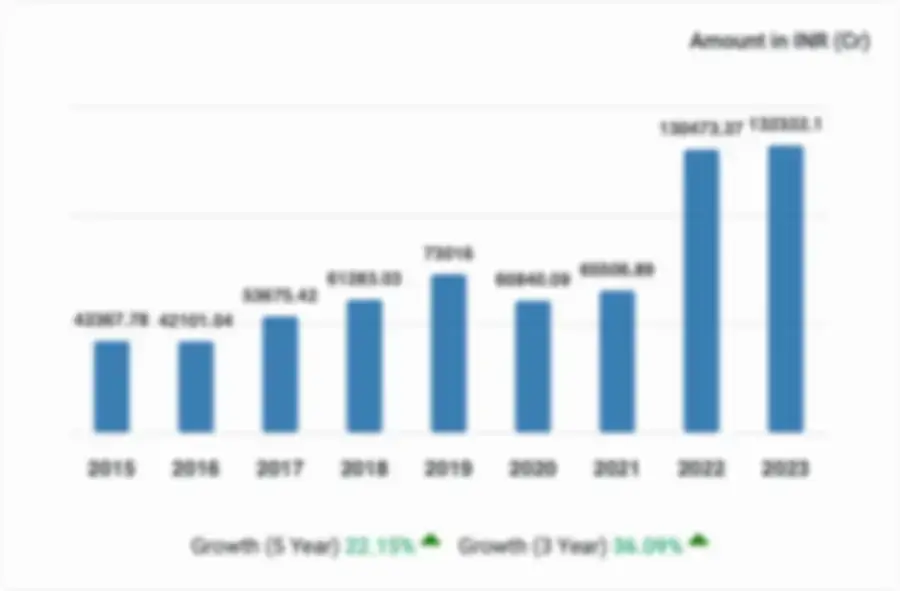

Financial Statements - H1

| Date | Amount | Transaction Name | Valuation | Lead Investors | Investors |

|---|---|---|---|---|---|

| Jul, 2021 | Amount | Post-IPO - Grab | Valuation |

investors |

|

| Feb, 2021 | Amount | Post-IPO - Grab | Valuation |

investors |

|

| Jan, 2021 | Amount | Post-IPO - Grab | Valuation |

investors |

|

| Feb, 2021 | Amount | Post-IPO - Grab | Valuation |

investors |

H1 Comparisons

Competitors of H1

H1 operates in a dynamic and competitive business environment, facing competition from various established players and emerging companies in the market. The competitive landscape includes prominent companies such as System Analytic, PeakData, QPharma, Aissel and Viscira, among others. This competitive environment drives innovation, market differentiation, and strategic positioning as companies strive to capture market share and deliver value to their customers. Understanding the competitive dynamics is crucial for assessing market positioning, identifying growth opportunities, and navigating the challenges inherent in a competitive marketplace.

| Company Name | Domain | Founded year | HQ Location | Description |

|---|---|---|---|---|

| domain | founded_year | HQ Location |

Digital tools are provided for monitoring HCP and KOL engagements.

|

|

| domain | founded_year | HQ Location |

Provider of a software platform to identify and analyze key opinion leaders

|

|

| domain | founded_year | HQ Location |

Provides pharmaceutical compliance, distribution, and digital tools for biotech sectors.

|

|

| domain | founded_year | HQ Location |

Cloud-based business intelligence and KOL Management software for healthcare and life sciences sector

|

|

| domain | founded_year | HQ Location |

Media marketing solutions are provided for life sciences sectors.

|

|

| domain | founded_year | HQ Location |

Platform provides oncology data tools and market insights for pharma companies.

|

| Company Name | Domain | Founded year | HQ Location | Description |

|---|---|---|---|---|

| domain | founded_year | HQ Location |

Multiple services are booked via an app-based platform.

|

|

| domain | founded_year | HQ Location |

On-demand services are booked through an app-based platform.

|

|

| domain | founded_year | HQ Location |

App based platform offering on demand delivery and ride-hailing services

|

|

| domain | founded_year | HQ Location |

Operates an on-demand hyperlocal delivery app for food and groceries.

|

Latest news on H1

Frequently Asked Questions about H1

When was H1 founded?

H1 was founded in 2017 and raised its 1st funding round 1 year after it was founded.

Where is H1 located?

H1 is headquartered in New York, United States. It is registered at New York, New York, United States.

Who is the current CEO of H1?

Ariel Katz is the current CEO of H1. They have also founded this company.

Is H1 a funded company?

H1 is a funded company, having raised a total of $378.86M across 7 funding rounds to date. The company's 1st funding round was a Series C of $120.96M, raised on Oct 29, 2018.

What does H1 do?

H1 is engaged in delivering data-driven solutions for the healthcare industry. Comprehensive analytics and software tools are offered to support clinical trials, medical affairs, and commercial strategies. Sectors served include life sciences, health plans, and digital health. Solutions such as Site Universe, Patient Universe, and HCP Universe are developed to enhance site selection, patient recruitment, and HCP engagement. Data accuracy and provider network insights are prioritized to bridge gaps between patients and treatments globally.

Who are the top competitors of H1?

H1's top competitors include System Analytic, PeakData and Viscira.

What products or services does H1 offer?

H1 offers Site Universe, Patient Universe, HCP Universe, Prescriber Universe, and H1 Foundation.

How many acquisitions has H1 made?

H1 has made 3 acquisitions, including Carevoyance, Faculty Opinions, and Ribbon Health.

Who are H1's investors?

H1 has 13 investors. Key investors include Novartis, European Union, Shore Group, Transformation Capital, and Menlo Ventures.

What is H1's valuation?

The valuation of H1 is $750M as of Nov 2021.